Introduction: In this article – part of an ongoing “Introduction to Genealogy” series – Gena Philibert-Ortega describes how poll tax and voting records can help fix your ancestor in a particular time and place. Gena is a genealogist and author of the book “From the Family Kitchen.”

Taxes. There’s no escaping them, but some taxes are much more than just money paid to the government. Case in point: poll taxes. In the 20th century, they were part of an effort to exclude certain people – who were eligible to vote – from voting.

About Poll Taxes

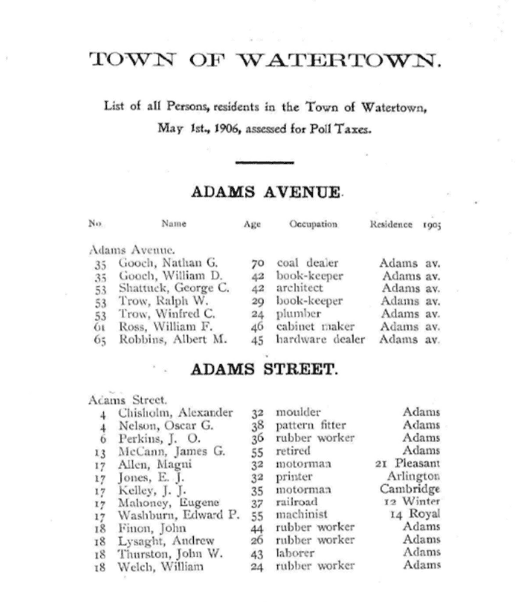

Poll taxes (poll meaning “head”) were “taxes paid for a head that was taxable.” (1) How long have poll taxes existed in the United States? “A poll tax was employed by all of the colonies at one period or another. It was the only direct tax levied in Virginia for years. In 1923, 38 of 48 states had poll tax provisions.” (2)

According to The Genealogist’s Guide to Researching Tax Records by Carol Cooke Darrow, CG and Susan Winchester, PhD, CPA:

“After the American Revolution some states used the payment of the poll or head tax as a substitute for land ownership as a requirement for voting, which broadened voting eligibility. New Hampshire, Georgia, and North Carolina adopted state constitutions allowing men to vote if they paid any state tax, and each of these states began to levy a poll tax.” (3)

Poll Taxes and Voting Rights

While the Southern United States didn’t invent poll taxes, the South used them and literacy tests to disenfranchise African Americans, women, and poor whites. In some cases, exemptions for paying poll taxes were made for those who had a father or grandfather who voted prior to the Civil War. Since this condition was something that no African American could meet, this exemption only benefited whites. (4) Poll taxes required someone to pay anywhere from the equivalent of $7 to $15 today, before they could register to vote. (5)

Authors Darrow and Winchester further explain:

“States enacted laws to make payment of a poll tax voluntary, but used it as a requirement for voting. Florida imposed the poll tax suffrage qualification in 1889. Mississippi, Tennessee, Arkansas, South Carolina, Louisiana, North Carolina, Alabama, Virginia, Texas and Georgia soon followed. The poll tax payment was required up to a year in advance of any election, and voters were usually asked to produce the receipt for payment of the tax at the time of voting. Those who could not show the receipt were prohibited from voting.” (6)

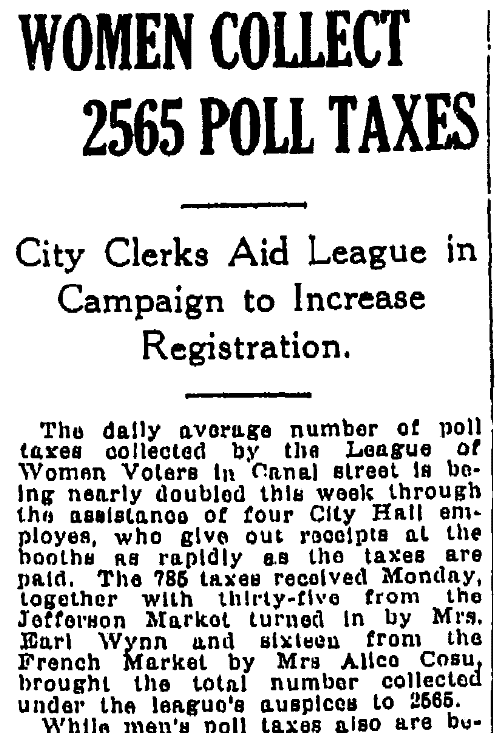

After 1920, both white and African American women were sometimes kept from voting because of poll taxes. One can understand how, due to difficult finances or a husband who refused to pay for his wife, some newly enfranchised women were still effectively prevented from voting.

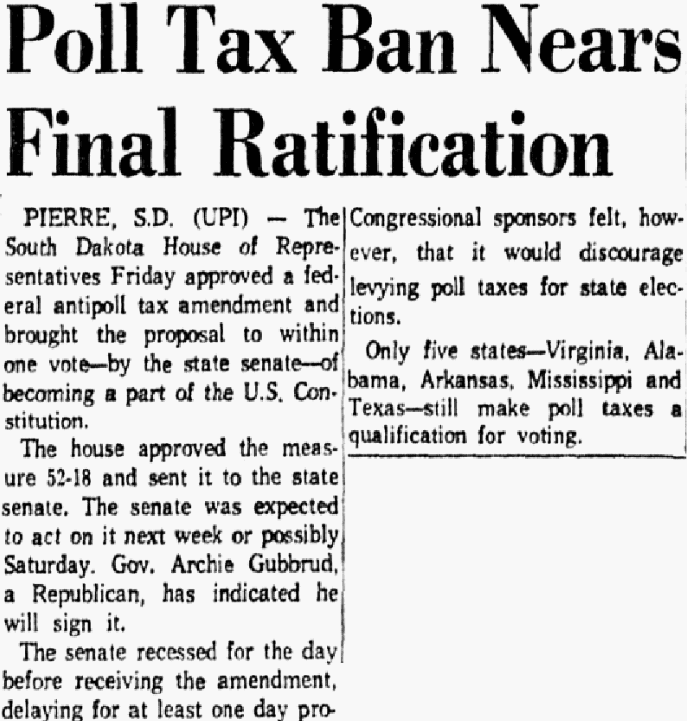

The 24th amendment to the U.S. Constitution, ratified in 1964, prohibits “states from conditioning the right to vote in federal elections on payment of a poll tax or other types of tax.” Although this amendment outlawed poll taxes for federal elections, it didn’t address state or local elections – and five states continued charging a poll tax after the amendment was passed: Alabama, Arkansas, Mississippi, Texas and Virginia. In 1966 the U.S. Supreme Court ruled that poll taxes were unconstitutional for any level of elections. (7)

Finding the Records

Tax records may be found in a variety of places. First, check FamilySearch. A search on the keywords “poll tax” in the FamilySearch Catalog provides an idea of what may be available. Also consider doing a Place search for the county you are researching, then clicking on the subject category Taxation to reveal possible records.

Also, check the FamilySearch Digital Library for possible indexes and other published poll tax lists. Because the Digital Library includes other libraries aside from FamilySearch, you may find something you wouldn’t have found otherwise.

Historical societies, libraries, and archives may also hold poll tax and voting records.

There’s More to Research

Voting records and poll taxes provide more records for us to fix our ancestor in a particular time and place. Have you used poll taxes in your research?

________________

(1) Darrow, Carol C, and Susan Winchester. The Genealogist’s Guide to Researching Tax Records. Westminster, MD: Heritage Books, 2007, p. 47.

(2) Walker, Harvey. “The Poll Tax in the United States.” The Bulletin of the National Tax Association, Vol. 9, No. 2 (November, 1923), p. 47. Available online from https://www.jstor.org/stable/41785656

(3) Darrow, Carol C, and Susan Winchester. The Genealogist’s Guide to Researching Tax Records. Westminster, MD: Heritage Books, 2007, p. 47-48.

(4) “Poll Taxes,” National Museum of American History (accessed 1 February 2020).

(5) “Gallup Vault: Lining Up against Poll Taxes,” Gallup (https://news.gallup.com/vault/196604/gallup-vault-lining-against-poll-taxes.aspx: accessed 2 February 2020).

(6) Darrow, Carol C, and Susan Winchester. The Genealogist’s Guide to Researching Tax Records. Westminster, MD: Heritage Books, 2007, p. 48-49.

(7) “Twenty-Fourth Amendment to the United States Constitution,” Wikipedia (https://en.wikipedia.org/wiki/Twenty-fourth_Amendment_to_the_United_States_Constitution: accessed 1 February 2020).

Related Articles: