Introduction: In this article, Katie Rebecca Garner gives tips for researching your ancestor’s tax records. Katie specializes in U.S. research for family history, enjoys writing and researching, and is developing curricula for teaching children genealogy.

Who likes taxes? Most people don’t. Our ancestors probably didn’t either, yet their tax records leave a genealogically valuable paper trail.

We are taxed at various jurisdictional levels, including federal, state, and local. This was also the case for our ancestors, so we should check records at every jurisdictional level of the place they lived. This includes city, county, state, and federal. If there were border changes of your ancestor’s locality during their lifetime, check the neighboring jurisdictions as well.

In our day and our ancestors’ days, governments used tax money to fund their programs. This includes schools, libraries, wars, aid for the poor, etc. Specifics about programs change as the needs of society change, but the concept remains the same.

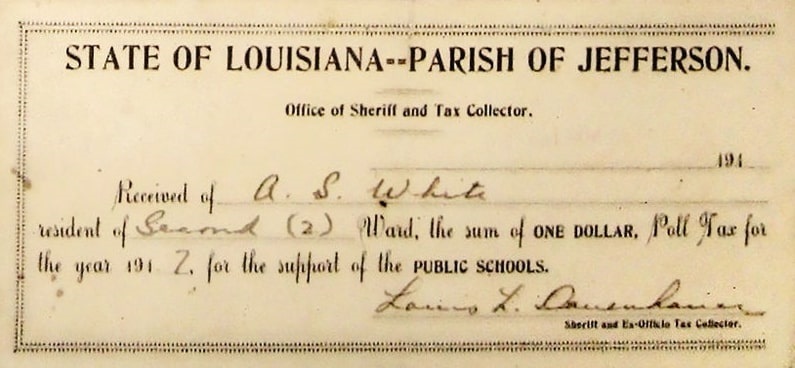

In the early days of our country, states often imposed poll taxes, which was usually a fixed tax on free, white males within a certain age range. Sometimes the poll applied to slaves and servants. The head of household was required to pay this tax for every qualifying person in his or her household.

Records of this tax would name the head of household and indicate how many polls were owed. By evaluating these records and comparing multiple years for the same household, you can estimate the ages of household members. You can determine when the head of household had a son old enough to become taxable and when that son established his own household.

Property tax was paid by property owners based on what property they owned. Both real estate and personal estate were taxed. The tax records for this kind of tax included what property was being taxed, including acreage and quality of land for real estate. Property tax also included estates of deceased men whose property had not yet gone to their heirs.

Where personal property was taxed, the items owned by the taxpayer were recorded. If you find property tax records for your ancestor, this tells you how wealthy your ancestor was. Tracking property taxes through multiple years can show your ancestor’s gain or decline in wealth. If it’s real estate increasing or decreasing, that’s a clue to search land records. If the estate of your deceased ancestor was taxed, you can find more information in his probate records.

Because no one is excited about taxes, some people tried to evade them. A young man who just became of taxable age may not have started paying taxes right away. People paying taxes on personal estate may have underreported what they owned. Tax-evading ancestors may have even been included in lists of delinquent taxpayers or had a lien placed on their property. There should be records of all of this.

Sometimes the government used lack of excitement about taxes to their advantage by offering tax exemptions. This included exempting homestead land from taxes under the Homestead Act. This also included tax exemptions for certain industries that the government wanted to increase at different times.

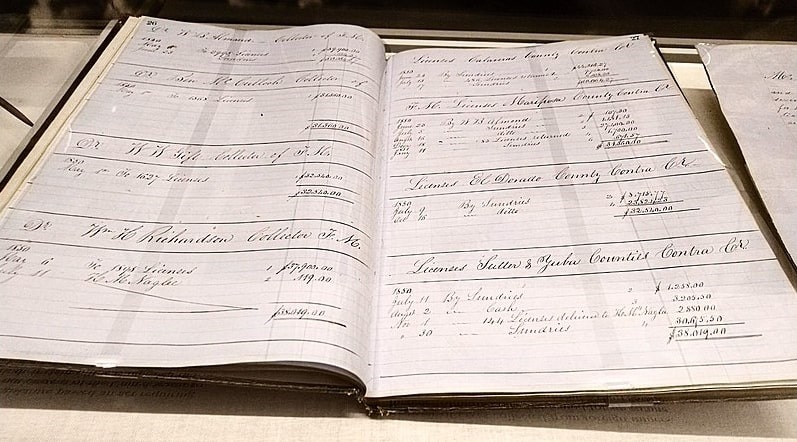

Tax records available for your ancestors depend on when and where they lived. Go to the FamilySearch Wiki page for your ancestor’s county or state and click “Tax Records.” You will be taken to a list of available resources to search for tax records for that area; choose the resources applicable to your ancestor’s time.

Another way to find tax records on FamilySearch is to go to the Card Catalog and do a search for tax records and your ancestor’s area. This will pull up digitized collections, some indexed and some not; and it will pull up microfilm and book collections available at the FamilySearch Library. The non-indexed records are sorted by location and year, so that you can find your ancestor via browsing if you know specifically where they lived.*

Whether your ancestor paid taxes or evaded them, records were kept. Search out these records to learn more about your ancestor.

* “The Genealogist’s Guide to Researching Tax Records” by Carol Cooke Darrow, CG, and Susan Winchester, Ph.D., C.P.A.

Explore over 330 years of newspapers and historical records in GenealogyBank. Discover your family story! Start a 7-Day Free Trial

Note on the header image: Pieter Brueghel the Younger, “Paying the Tax (The Tax Collector),” 1640. Credit: USC Fisher Museum of Art; Wikimedia Commons.